Virginia Sales Tax Holiday Weekend for Emergency Preparedness Supplies, School Supplies, Clothing & more – August 2-4

Virginia’s 3-Day Tax Free Weekend

It’s smart to get ready for hurricane, flash flooding season, school supplies and it’s smart to save money. During the sales tax holiday, you can buy qualifying items without paying sales tax.

When is it?

August 2-4, 2024. The 3-day sales tax holiday starts the first Friday in August at 12:01 am and ends the following Sunday at 11:59 pm.

What is it?

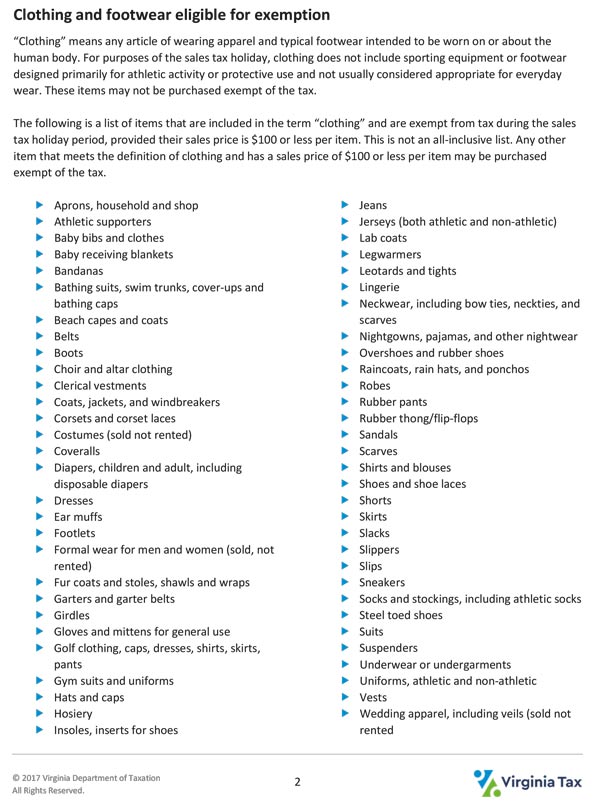

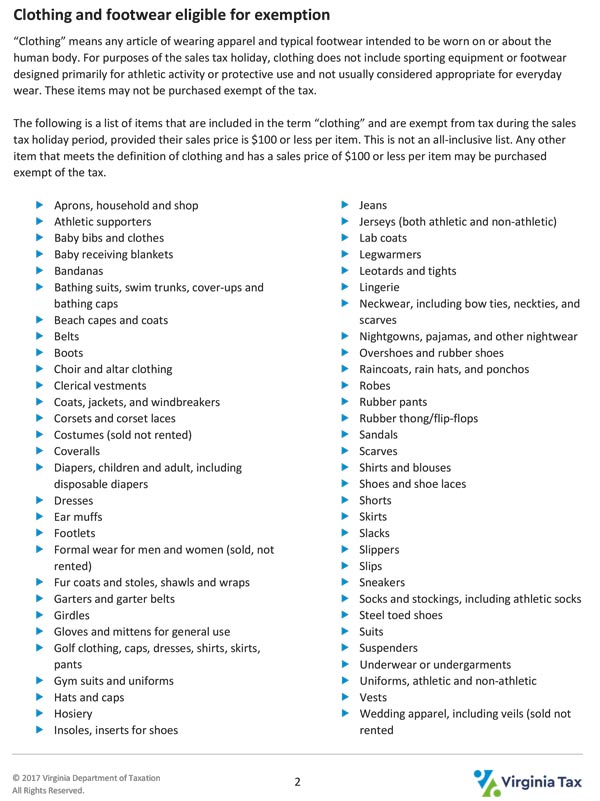

During the sales tax holiday, you can buy qualifying school supplies, clothing, footwear, hurricane and emergency preparedness items, and Energy Star™ and WaterSense™ products without paying sales tax.

What items are eligible?

- School supplies, clothing, and footwear

- Qualified school supplies – $20 or less per item

- Qualified clothing and footwear – $100 or less per item

- Scroll Down for the full list of School Supplies and Clothing that qualify for Tax Free

- Hurricane and emergency preparedness products

- Portable generators – $1,000 or less per item

- Gas-powered chainsaws – $350 or less per item

- Chainsaw accessories – $60 or less per item

- Other specified hurricane preparedness items – $60 or less per item

- Energy Star™ and WaterSense™ products

- Qualifying Energy Star™ or WaterSense™ products purchased for noncommercial home or personal use – $2,500 or less per item

Detailed lists of qualifying items and more information for retailers can be found in the Sales Tax Holiday Guidelines.

See below for School Supply List for Williamsburg-James City County Public Schools.