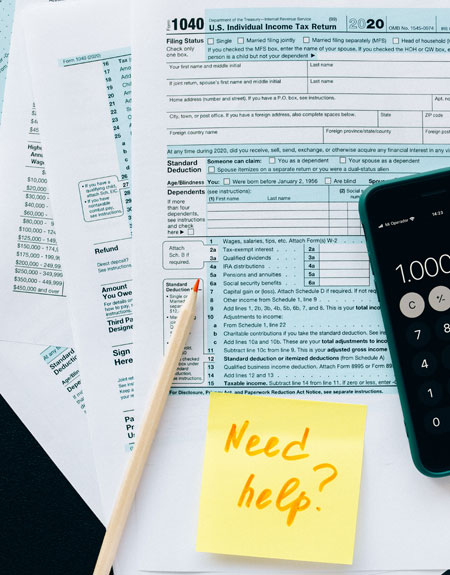

VITA Free Tax Preparation Service

VITA Free Tax Preparation Service 2022

The Greater Williamsburg Volunteer Income Tax Assistance (VITA) program will provide Free Tax Preparation and Electronic Filing (e-filing) services this year. This FREE Service is available to all, though they hope to assist those for whom the cost of a paid preparer might be burdensome.

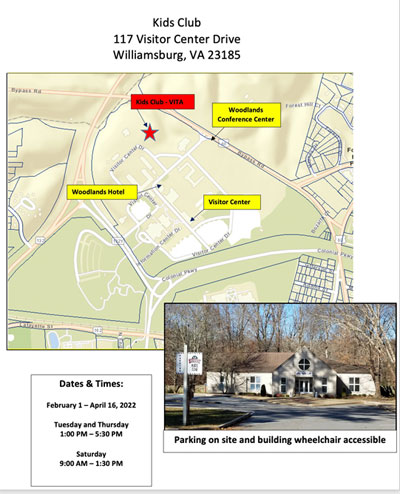

From February 1 through April 16, 2022, VITA volunteers, trained by the Internal Revenue Service, will complete and electronically file “while-you-wait” basic Federal and state income tax returns on a first-come, first-served basis at one location only at Colonial Williamsburg Foundation Kids Club, 117 Visitor Center Drive, Williamsburg, VA.

- Tuesdays and Thursdays – 1:00 pm-5:30 pm

- Saturdays – 9:00 am – 1:30 pm

In order to provide the safest environment during this COVID environment, after signing in, you may be asked to wait in your car until a volunteer ready to help with your return. Masks will be required whenever you are in the building. Also, we cannot accommodate children on site at this time.

The program is limited to simple 1040 Federal returns and State returns. We cannot calculate or prepare returns where self-employment income is more than $25,000 and/or expenses that exceed income.

Filers should bring:

Year 2019 and 2020 tax returns, including wage and earnings statements (W2s and 1099s), receipts for deductions; a driver’s license or other government-issued picture ID; taxpayer and dependent Social Security cards; bank account routing information if e-filing, and any other relevant information about income, expenses and deductions.

Here is an electronic version of the Intake/Interview Sheet that you’re asked to complete prior to your arrival (pages 1 through 3) – DO NOT COMPLETE page 4. https://www.irs.gov/pub/irs-pdf/f13614c.pdf

Greater Williamsburg VITA Team wmsbrgvita@gmail.com